Bitcoin's recent surge to $105,000 has not alleviated growing concerns regarding its market momentum. The leading cryptocurrency recorded a modest increase of 0.03% over the past 24 hours, yet it remains 3.5% lower than its value a week prior. Analyst Captain Faibik suggests that this combination of stagnant gains and diminishing strength may indicate that traders are purchasing Bitcoin at peak levels.

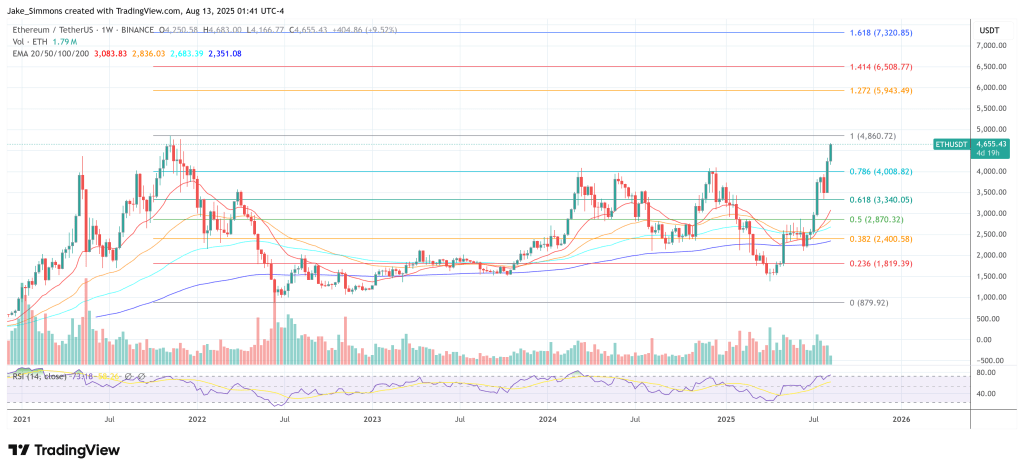

The Relative Strength Index (RSI) has shown a downward trend after reaching a peak near 80, even while Bitcoin's price continued to rise. Currently, the RSI stands at 61.88, signaling that buying pressure is waning. Traders often monitor such discrepancies—where prices rise alongside a falling RSI—as they may indicate an impending pullback. Historical data suggests that while this scenario doesn’t always result in a significant decline, it does increase the likelihood of a correction.

According to Faibik, after reaching new highs, Bitcoin appears to have hit a ceiling, with a potential pullback anticipated in the $92,000 to $94,000 range. This situation typically triggers a swift correction, prompting many traders to closely monitor the market and adjust their strategies accordingly.

Bitcoin is facing significant resistance levels around $108,000 and $109,000, both established on May 19. An ascending trendline from December 2024 has also been limiting gains for weeks, making it challenging for the cryptocurrency to surpass these barriers. Faibik notes that encountering these resistance points alongside RSI divergence often signifies a peak before a downturn.

In the derivatives market, trading volume for Bitcoin futures and options has increased by 1.60%, bringing total activity to approximately $100 billion, while open interest has decreased by 1.30% to nearly $70 billion. This trend suggests that some traders are closing their positions rather than increasing their exposure. In the last 24 hours, liquidations have resulted in a loss of $71 million in long positions, which could prompt further sell-offs as investors rush to secure their profits.

Reflecting on past trends, Bitcoin's recovery in 2022 followed a different pattern. At that time, the price had dropped to around $16,000 and gained strength even as the RSI improved from oversold conditions, leading to a robust rally. Currently, however, the RSI is not near oversold territory, serving more as a cautionary signal than an indicator of potential gains. Captain Faibik advises traders that previous successes do not ensure future performance, especially given the current environment of elevated interest rates and increased institutional interest, which may alter Bitcoin's response to similar market signals.