Whale Alert, a blockchain tracking service, recently reported a significant transfer of 129,392 ETH from an unidentified wallet to Coinbase, coinciding with a downturn in Ethereum's price. On-chain data from Etherscan reveals that this wallet had not engaged in substantial ETH transactions since November 2022, raising concerns about a potential selloff given the timing of this deposit into a centralized exchange.

According to Whale Alert, which initially shared the news on the social media platform X, the transferred ETH was valued at approximately $312.9 million at the time of the transaction. This transfer is particularly notable as it occurred when Ethereum's price struggled to maintain levels above $2,500, with a notable decline below $2,400.

Etherscan's data indicates that the wallet in question, identified as “0xd47b,” had been relatively dormant since late 2022, with its last recorded transaction being an inflow of 6,469 ETH from another wallet associated with Coinbase. This recent influx into Coinbase raises the likelihood of a selloff through the exchange, especially as Ethereum has recently lost a crucial support level at $2,450 and experienced a significant price drop over the last two days.

While various factors, including escalating geopolitical tensions following U.S. military action in Iran, have contributed to the price decline, the substantial deposit into Coinbase may have intensified the downward pressure on Ethereum's value. Such large inflows are often indicative of impending liquidation, particularly amidst a climate of heightened investor anxiety.

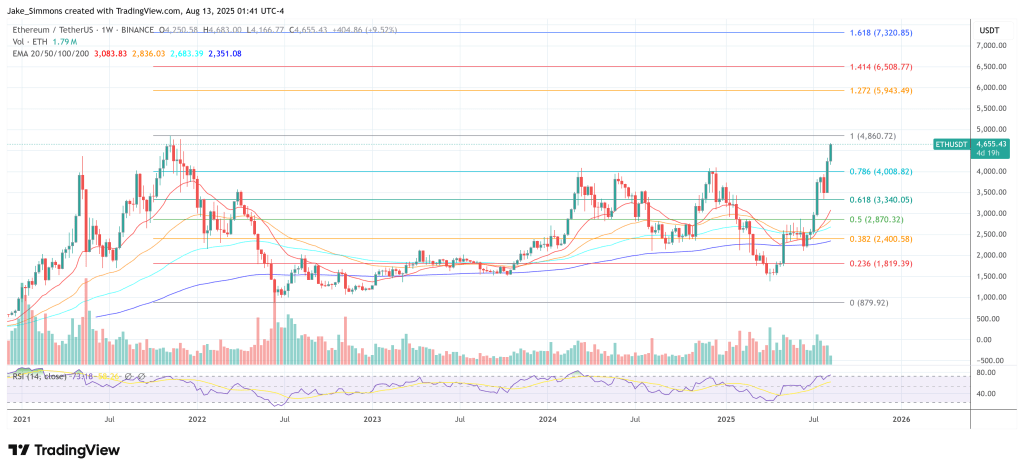

The technical outlook for Ethereum appears increasingly bearish in the short term. An analysis of Ethereum’s 4-hour chart on TradingView indicates a clear breakdown after the cryptocurrency fell below a critical support line at $2,362. This breach has solidified a bearish scenario moving forward.

The accompanying chart, featuring overlays of the Ichimoku Cloud, illustrates a waning bullish momentum in recent days. Previous unsuccessful attempts to breach resistance have left Ethereum in a precarious position, and this recent whale selloff may be the catalyst needed to drive prices lower. If this trend continues, Ethereum could be headed towards retesting lows beneath $2,000. TradingView analysis suggests potential reversal targets at $2,151 and $1,954, with a further level at $1,750 should the selloff exceed expectations.

As of now, Ethereum's trading price stands at $2,290, reflecting a decline of 5.5% over the past 24 hours and a 10% drop over the past week.