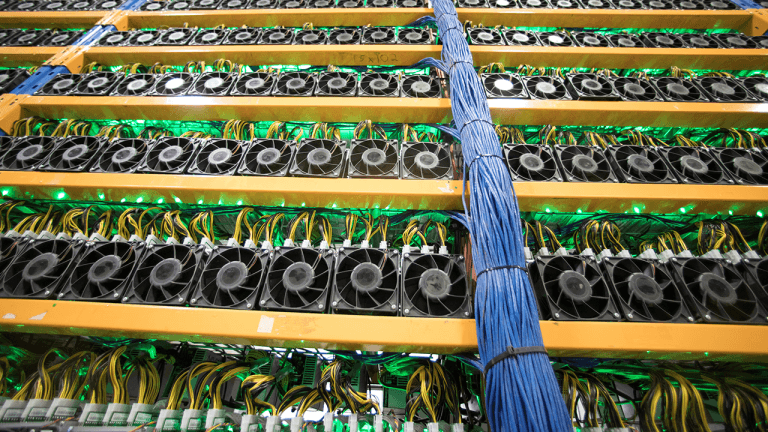

Bitcoin is currently generating significant attention, especially after reaching a record high of $111,900 on May 22, 2025. Since then, the cryptocurrency has fluctuated below this peak but has not dipped below the $100,000 mark, usually stabilizing between $105,000 and $110,000. As positive sentiment around Bitcoin begins to rise again, there are questions about whether this will trigger a new market surge. In this context, the presale of Bitcoin Hyper ($HYPER), the first Layer-2 solution utilizing the Solana Virtual Machine, could see substantial interest.

One factor contributing to recent selling pressure may be long-term Bitcoin holders deciding to cash in. Investors who acquired Bitcoin when it was valued at just a few thousand dollars—below $10,000 as of July 1, 2020—might now feel inclined to sell, having seen their investments increase tenfold or more. However, this does not necessarily spell trouble for Bitcoin; a tightening supply could counterbalance the increased selling activity. On-chain analytics indicate that the amount of Bitcoin held on exchanges has been declining even as prices rise, suggesting that weak demand has been the primary factor keeping Bitcoin's price in check, a trend unlikely to persist indefinitely.

According to Hunter Horsley, CEO of Bitwise, the tightening supply will intensify once Bitcoin surpasses the $130,000 to $150,000 range, prompting HODLers to re-engage with the market. If this prediction holds true, the fundamental economic principle of supply and demand could significantly elevate Bitcoin's price. Furthermore, institutional investors are feeling increasingly optimistic, which adds to the positive sentiment surrounding Bitcoin, even as retail investors exhibit mixed behavior. Notably, GameStop recently acquired 4,700 Bitcoin and is planning to issue $1.75 billion in convertible notes to facilitate further purchases. A recent report from Santiment indicates that positive sentiment within the Bitcoin community is on the rise, with favorable comments outnumbering negative ones by more than two to one. This growing excitement for Bitcoin suggests that presales like Bitcoin Hyper could experience rapid growth.

Bitcoin Hyper ($HYPER) aims to redefine Bitcoin beyond a mere store of value, transforming it into a platform for crypto payments, meme coins, decentralized applications (dApps), and smart contracts. The technical foundation of Bitcoin Hyper is straightforward; through the Bitcoin Relay Program, any Bitcoin deposited into a designated address can be minted on the Bitcoin Hyper Layer 2. This Layer 2 utilizes the Solana Virtual Machine for enhanced throughput and scalability, positioning $HYPER as one of the most promising crypto presales of 2025. Ultimately, it features a Zero-Knowledge (ZK) Layer 2 that is trustless yet fully synchronized with the Bitcoin Layer 1 blockchain. The $HYPER token, which serves as the native currency for this Layer 2, offers several advantages, including low gas fees (paid in $HYPER), staking rewards with an impressive annual percentage yield (APY) of 647%, participation incentives, and developer bounties.

The presale for Bitcoin Hyper has seen explosive growth, raising over $1 million within days. Currently priced at $0.01185, the project has secured $1.13 million in funding so far. Predictions suggest that the price could reach $0.02595 by the end of 2025, marking a potential increase of 118%. Investing in $HYPER offers an opportunity to join a community of innovators eager to elevate Bitcoin's role within the dApp ecosystem.

As Bitcoin's supply becomes scarcer, demand is expected to rise, likely driving further increases in both Bitcoin and associated projects like Bitcoin Hyper. Given that $HYPER’s utility focuses on enhancing Bitcoin's readiness for future adoption, its market potential is evidently significant. As always, it is essential for investors to conduct their own research, as this information is not financial advice.