Bitcoin (BTC) remains range-bound in the mid-$100,000s, showing no clear directional bias. However, the Hash Ribbons indicator is now flashing a fresh buy signal, suggesting that the top cryptocurrency may be gearing up for its next upward move.

According to a recent CryptoQuant Quicktake post by contributor Darkfost, Bitcoin’s Hash Ribbons are signalling a potential prime buying opportunity for the leading digital asset. This signal coincides with Bitcoin’s hashrate reaching new all-time highs (ATH).

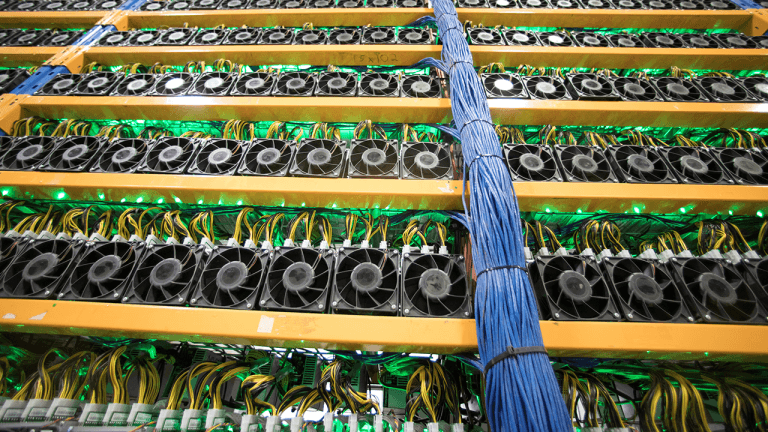

For the uninitiated, Bitcoin Hash Ribbons is an on-chain indicator that analyzes miner stress by comparing the 30-day and 60-day moving averages of Bitcoin’s hashrate. When the short-term average crosses above the long-term average after a period of decline, it signals that miner capitulation is ending – often marking a strong long-term buying opportunity. Such signals can emerge when mining becomes unprofitable for certain miners, forcing them to sell their BTC holdings to stay afloat. These sell-offs may temporarily pressure the price, but historically they have created attractive long-term buying opportunities.

In their analysis, Darkfost notes that while the current signal is bullish from a long-term perspective, it could lead to a short-term pullback in BTC price. However, he emphasizes that any dip should be viewed as a chance to accumulate. Darkfost also pointed out that the Hash Ribbons indicator has historically been reliable, with the exception of 2021 during the China mining ban. They shared a chart illustrating how the indicator is currently showing a strong buy signal.

While the Hash Ribbons suggest a favorable long-term setup, some analysts warn that the short-term correction could be deeper than expected. For instance, crypto analyst Xanrox used the Fibonacci levels to forecast that BTC may tumble as low as $98,000.

Similarly, analyst Jelle noted that Bitcoin may face “one last speed bump” before launching a major rally to $140,000. Meanwhile, more pessimistic voices continue to warn of a dramatic crash, with some speculating that BTC could fall below $10,000 – a view seen as increasingly unlikely by most market participants.

Despite the varying predictions, fresh on-chain data points to a healthy BTC market in the near to medium term. For instance, CryptoQuant contributor Amr Taha recently highlighted that the derivatives market has undergone a reset, with funding rates stabilizing around neutral levels. Similarly, Fundstrat’s Head of Research, Tom Lee foresees BTC surging to as high as $250,000 by the end of the year.

At press time, BTC trades at $105,367, up 0.5% in the past 24 hours.